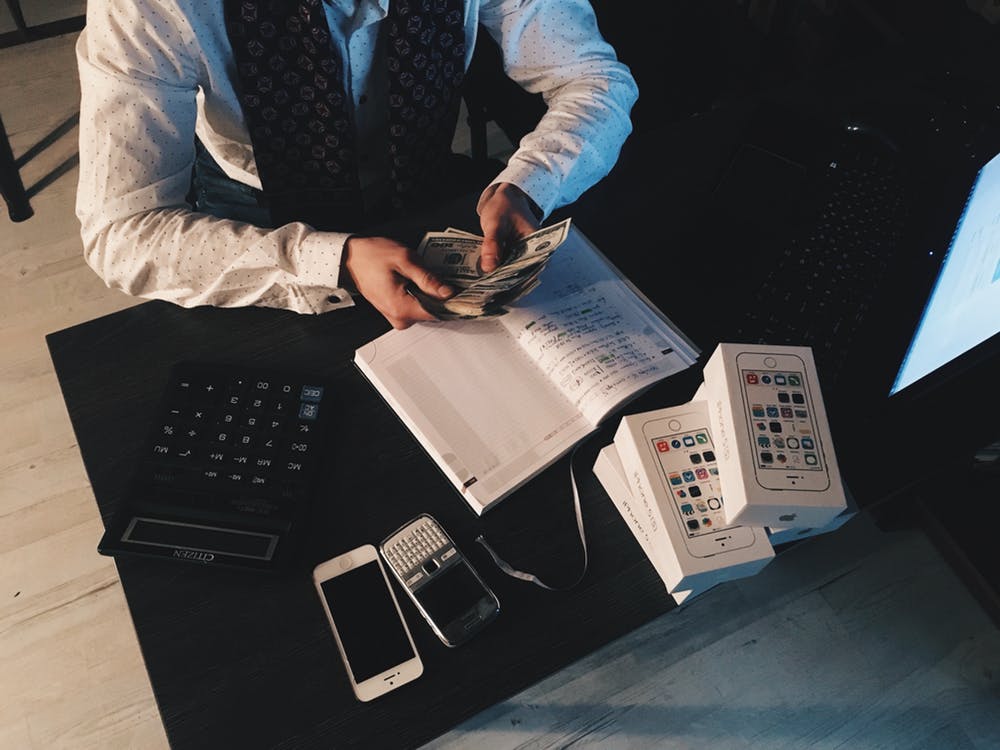

Money, its holding, spending and doubling are all that the business is about. The fact that each business requires money for starting, supporting and reviving in the field can never be ignored. Money is all that is supposed to be handled and spent in a way that it gets doubled and pays the hard work off. Money if spent wrong and in any inopportune launch, come-back or interval can result in the downfall of the business hence drowning of investment. This is the positive cash flow that even results in the punctual payments of the employees.

Business either of large industries or small firms needs perfect budgeting, priority index, and reliable record storage and technological innovation. Each of the tasks described needs efficient investment to satisfy the client with the best quality products. All of the tasks described need management in accounts and in the production unit as well. Rightly managed accounts and the person handling those saves time with efficiency and money every time.

An accountant, to handle revenues, expenses, liabilities, balance sheets, assets, income statements, etc is hired in every business regardless of its type. He records transactions with cash flow and is supposed to manage debt situations even if applying for a loan. Along with testing business strategy and budgeting accurately in specialized software an accountant can make you pay taxes on time and manage tax debts as well. The accountants according to their fields can be

- Public accountants working in private companies rendering their services on the basis of education.

- Government accountants work at provincial or federal levels.

- Internal audits working in certain companies to define the financial performance of different departments.

GUIDE TO BE AN ACCOUNTANT

Generally relevant qualifications along with computer skills are considered mandatory to be a professional and successful person in any field. Below are the certain guidelines of how to be an accountant:

- The foundations of an accountant are strong if he has a strong history of mathematics and business education. Communication skills are also very important for an accountant as in the modern world, critical thinking and practical implementation of his knowledge while making presentations and understanding facets of the business are preferred.

- The first and foremost step of becoming an accountant is qualifying in the relevant field. A bachelor’s and master’s degree according to the company’s preference is required in the aspirants. After completing the degree and gaining experiences through internships and fieldwork, an accountant needs to determine that in which sector of accounting he is interested in. Public accounting and governmental accounting are the basic separators in the field. Certified Public Accountant (CPA) certification, certified management accountant (CMA), Certified Financial Analyst (CFA), certified internal auditor (CIA), Enrolled Agent Certification (EA) are the certifications that are preferred in many business firms and industries while hiring. The certifications moreover a sometimes sponsored by the employer or the company directly.

- After having accounting specialties the jobs can be of the auditor, corporate accountant, forensic accountant, management accountant, personal financial planners, staff accountants, and tax advisors. Auditors analyze the company’s finances overall and department wise too. They manage accounts while analyzing the risk level of the company’s finances. Preparing reports on the analysis, making financial statements and being closely in touch with the managers is included in their job task.

- Corporate accountant, however, analyzes ledger balances and plans the budget of the company. He is there to supervise the accounting staff while preparing and filing local tax returns.

- A forensic accountant is specialized in dealing with frauds, bankruptcy and all the related issues in which the company is stuck in.

- Management accountant deals with the funding and resources of the company and makes significant decisions regarding finances. He moreover recommends business opportunities as well.

- Personal financial planners plan the strategies for their clients to meet their goals.

- Tax advisors in their job review tax returns for legal compliance and do advocate on the client’s behalf. They conduct audits and investigations on finances, their usage, and poor performances. They are experts and have a command over tax laws. The qualification is more often Higher than BS or graduation in many places.

SKILLS FOR AN ACCOUNTING ASPIRANT

There are certain skills that an account needs to develop in his personality to become a professional in the field.

- An accountant needs to be an expert in the number game. The important point is that this is not the only but the basic requirement of an accountant.

- The organized mindset with the likeness towards cleanliness is the other basic requirement of an accountant. He needs to deal with the numbers and the records for which his organized table and arranged records will help him keep the records accurate.

- An accountant has an investigating mindset in working while in work hours. He has to figure out the problem if the numbers and profits are not doubling up.

- He has authority over technology. He knows to work in spreadsheets, accounting specialized software, etc. This is with the advent of technology as now each field uses software to keep the records and data accurate with a sound backup plan.

CONCLUSION

An accountant is sometimes taken as light in his job and growth rate. While with the certification and advance degree programs offered for regular students along with online degree programming is getting important. The modern certification in the relevant fields has increasedthe value of the accounting field along with the job growth rates.An accountant overall needs personal skills, communication skills and qualification of at least graduation and higher for more attractive packages and enhanced knowledge. He needs to be organized, number game player and technological expert to stand firmly. In modern times accountants not just work in firms and industries but are hired as personal financial planners as well. For accounting tasks, companies have distinctive software to work, upload and keep records in.

Leave a Reply